Comments, feedback or

suggestions?

Please contact us.

Global value creation stories

Authors

Corporate website

©2023 Eight International

eight insights

The road less traveled:

Buy-and-build integration as an alternative path to value

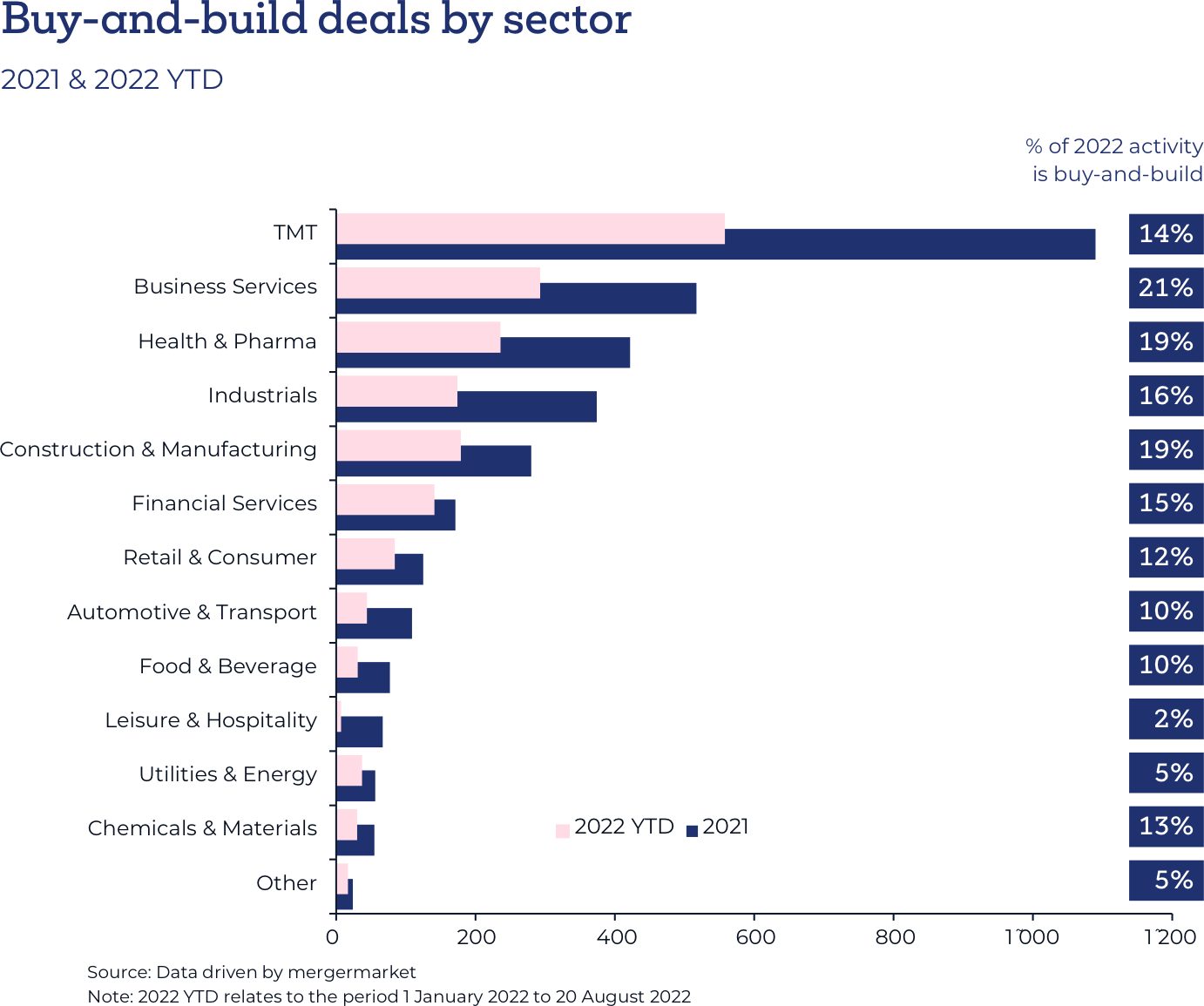

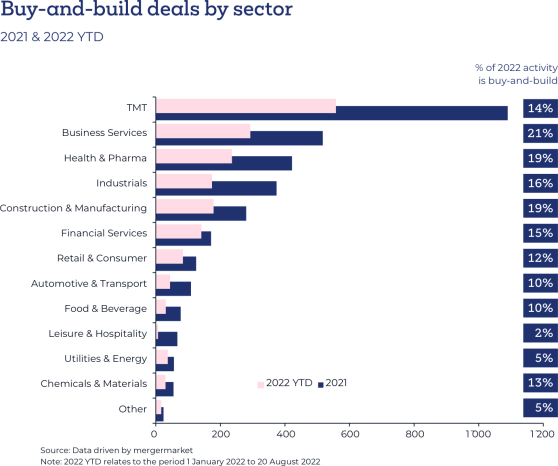

As inflation continues to rise and recession creeps closer, many investment firms are looking for alternative paths to value. One such path is ‘buy-and-build’, in which a firm uses a so-called platform business to drive growth by rapidly acquiring and integrating similar businesses in the same sector.

The success of a buy-and-build strategy is not a foregone conclusion, however. It needs to target thriving sectors with the right attributes. For example, sectors with consistency across businesses will ensure repeatability, while growing sectors offer an abundance of new targets. The chosen sector should also provide scope for new businesses to flourish, providing a healthy flow of deals.

Buy-and-build success also hinges on effective integration. While buy-and-build programs share some similarities with ‘standard’ integration, which allows the business to focus on one acquisition at a time, they play out very differently. Although buy-and-build acquisitions tend to be smaller than mergers, the sustained pace of change within the platform organization often leads it to being, and feeling, worlds apart from where it started.

What to look out for

If you’re considering the buy-and-build route, there are several things to keep in mind.

First, buy-and-build may mean juggling the integration of several deals at once, so having robust program management in place is a must. You’ll have to rely on the platform business being able to endure organic growth and generate cash reliably.

Second, buy-and-build strategies don’t have the luxury of time. Forget the typical 18–24-month integration schedule: each individual acquisition must be delivered at pace.

Finally, the management team of the platform business acts as an extension of the investment team, and vice versa. It’s crucial that both are aligned on goals, values, and rewards.

A bit of route planning goes a long way

Now that you know what to look out for, the next question is: where to start? Here’s a list of action points to consider:

- M&A integration playbook: make sure you have the necessary training,

approach, tools, and methodologies in place to ensure rapid integration. - Operational due diligence: understand your target’s operations to make

sure it’s a good match. - Technology due diligence: identify the risks and opportunities of the

asset’s IT, technology, and data landscape. - Integration due diligence: determine the effectiveness of a buy-and-build program.

- Buy-and-build strategy and planning: develop a plan with investors and

management, and ensure alignment. - Day-one readiness: ensure business continuity of the target on Day 1.

- Integration delivery: establish integration objectives, including

operational changes and synergy capture. - Buy-and-build program management: put solid program management

in place to effectively integrate each acquisition. - Optimization of the standalone entity: create value within a broader

transformation, including performance improvement and digital

transformation.

Download

the white paper

To find out more about the complexities of buy-and-build integration and how Eight International can support you at all stages of the journey, read our full white paper:

Buy-and-build integration: How to deliver a buy-and-build program that maximizes value.

Related articles

READ MORE

Crystal clear?

Looking at business

through an ESG lens

Digital transformation in the Experience Age

READ MORE

How to weather

the inflation storm

READ MORE

READ MORE

Rapid cost reduction programs: For speed, ease, and control

READ MORE

What’s trending in M&A

READ MORE

Fix, sell, or buy?

Making sense of the valuation landscape

READ MORE

Related articles

READ MORE

Crystal clear?

Looking at business

through an ESG lens

READ MORE

What’s trending in M&A

Authors

Download

the white paper

To find out more about the complexities of buy-and-build integration and how Eight International can support you at all stages of the journey, read our full white paper:

Buy-and-build integration: How to deliver a buy-and-build program that maximizes value.

A bit of route planning goes a long way

Now that you know what to look out for, the next question is: where to start? Here’s a list of action points to consider:

- M&A integration playbook: make sure you have the necessary training,

approach, tools, and methodologies in place to ensure rapid integration. - Operational due diligence: understand your target’s operations to make

sure it’s a good match. - Technology due diligence: identify the risks and opportunities of the

asset’s IT, technology, and data landscape. - Integration due diligence: determine the effectiveness of a buy-and-build program.

- Buy-and-build strategy and planning: develop a plan with investors and

management, and ensure alignment. - Day-one readiness: ensure business continuity of the target on Day 1.

- Integration delivery: establish integration objectives, including

operational changes and synergy capture. - Buy-and-build program management: put solid program management

in place to effectively integrate each acquisition. - Optimization of the standalone entity: create value within a broader

transformation, including performance improvement and digital

transformation.

What to look out for

If you’re considering the buy-and-build route, there are several things to keep in mind.

First, buy-and-build may mean juggling the integration of several deals at once, so having robust program management in place is a must. You’ll have to rely on the platform business being able to endure organic growth and generate cash reliably.

Second, buy-and-build strategies don’t have the luxury of time. Forget the typical 18–24-month integration schedule: each individual acquisition must be delivered at pace.

Finally, the management team of the platform business acts as an extension of the investment team, and vice versa. It’s crucial that both are aligned on goals, values, and rewards.

The success of a buy-and-build strategy is not a foregone conclusion, however. It needs to target thriving sectors with the right attributes. For example, sectors with consistency across businesses will ensure repeatability, while growing sectors offer an abundance of new targets. The chosen sector should also provide scope for new businesses to flourish, providing a healthy flow of deals.

Buy-and-build success also hinges on effective integration. While buy-and-build programs share some similarities with ‘standard’ integration, which allows the business to focus on one acquisition at a time, they play out very differently. Although buy-and-build acquisitions tend to be smaller than mergers, the sustained pace of change within the platform organization often leads it to being, and feeling, worlds apart from where it started.

As inflation continues to rise and recession creeps closer, many investment firms are looking for alternative paths to value. One such path is ‘buy-and-build’, in which a firm uses a so-called platform business to drive growth by rapidly acquiring and integrating similar businesses in the same sector.

eight insights

Buy-and-build integration as an alternative path to value

The road less traveled:

Global value creation stories

Corporate website

©2023 Eight International