Comments, feedback or

suggestions?

Please contact us.

Global value creation stories

Authors

Corporate website

©2023 Eight International

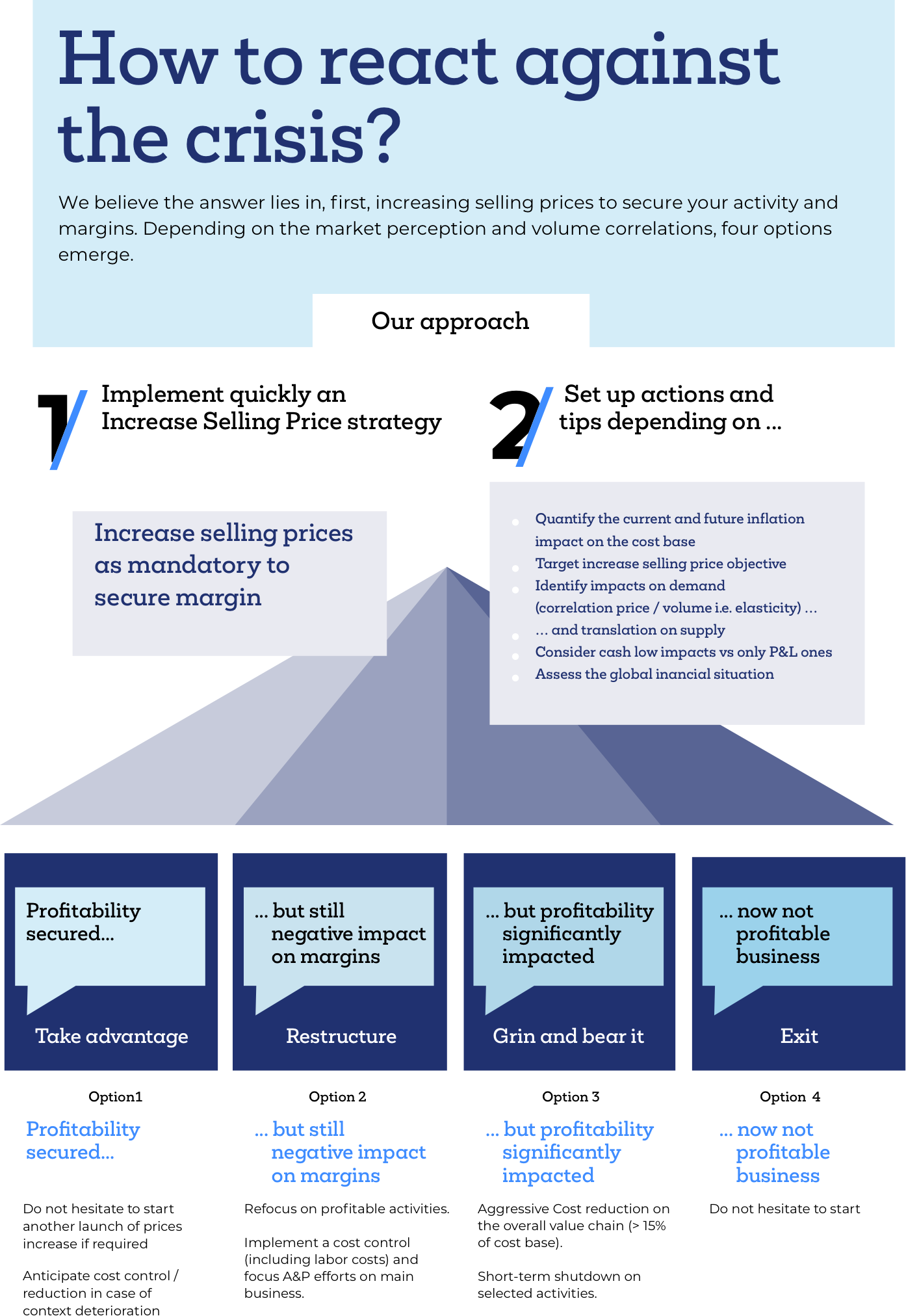

Scenario three: volume has been affected and margin has taken a hit.

Recommended action: restructure. Temporarily shut down selected activities, cut costs on the overall value chain, and focus on your most profitable clients.

Scenario four: price increases haven’t solved issues caused by inflation.

Recommended action: wind up activities and go into liquidation. It might not be anyone’s first choice, but having – and acting on – a strong exit plan can be the best move when you’re in dire straits.

Scenario two: volume is secured but margin is affected.

Recommended action: grin and bear it. Introduce a cost-control policy on general and administrative expenses, including labor costs, and limit advertising and promotion. Meanwhile, refocus attention on more profitable activities, which also means limiting innovation and product launches.

There are four possible scenarios resulting from this strategy, each of which would need to be managed in a different way. Here are our tips to help managers get through the crisis and come out stronger at the other end.

Scenario one: volume and margin are unaffected.

Recommended action: accelerate. Maintain your higher selling prices and business-as-usual strategy. But be sure to stay on your guard and stay agile, because you may need to reduce costs if the situation deteriorates.

Four scenarios – and four responses

eight insights

How to weather

the inflation storm

Not since the 1970s has the global economy experienced such an alarming rise in inflation. The current economic malaise is widespread, impacting energy, raw materials, wages, and interest rates – and many experts believe we could be heading for a global recession. So, how will inflation (and a looming recession) impact managers, and what can they do to ride out the storm?

The short answer? First, strategize by increasing selling prices. This is a mitigating step to secure companies’ margins against the threat of deterioration. Then, and only then, work to secure profitability on a cost basis – business by business, geography by geography, and product by product.

Download

the white paper

To find out more about what causes inflation, why this situation is new to managers who’ve joined the profession in recent decades, and the best way to develop and implement a sound pricing strategy, read our white paper in full: The inflation crisis and recession: How to respond.

Related articles

READ MORE

Crystal clear?

Looking at business

through an ESG lens

READ MORE

Digital transformation in the Experience Age

READ MORE

The road less traveled: Buy-and-build integration as an alternative path to value

READ MORE

Rapid cost reduction programs: For speed, ease, and control

READ MORE

What’s trending in M&A

READ MORE

Fix, sell, or buy?

Making sense of the valuation landscape

READ MORE

Corporate website

©2023 Eight International

Related articles

READ MORE

Crystal clear?

Looking at business

through an ESG lens

Authors

Download

the white paper

To find out more about what causes inflation, why this situation is new to managers who’ve joined the profession in recent decades, and the best way to develop and implement a sound pricing strategy, read our white paper in full: The inflation crisis and recession: How to respond.

Scenario four: price increases haven’t solved issues caused by inflation.

Recommended action: wind up activities and go into liquidation. It might not be anyone’s first choice, but having – and acting on – a strong exit plan can be the best move when you’re in dire straits.

Scenario three: volume has been affected and margin has taken a hit.

Recommended action: restructure. Temporarily shut down selected activities, cut costs on the overall value chain, and focus on your most profitable clients.

Scenario two: volume is secured but margin is affected.

Recommended action: grin and bear it. Introduce a cost-control policy on general and administrative expenses, including labor costs, and limit advertising and promotion. Meanwhile, refocus attention on more profitable activities, which also means limiting innovation and product launches.

Scenario one: volume and margin are unaffected.

Recommended action: accelerate. Maintain your higher selling prices and business-as-usual strategy. But be sure to stay on your guard and stay agile, because you may need to reduce costs if the situation deteriorates.

There are four possible scenarios resulting from this strategy, each of which would need to be managed in a different way. Here are our tips to help managers get through the crisis and come out stronger at the other end.

Four scenarios – and four responses

The short answer? First, strategize by increasing selling prices. This is a mitigating step to secure companies’ margins against the threat of deterioration. Then, and only then, work to secure profitability on a cost basis – business by business, geography by geography, and product by product.

eight insights

How to weather

the inflation storm

Not since the 1970s has the global economy experienced such an alarming rise in inflation. The current economic malaise is widespread, impacting energy, raw materials, wages, and interest rates – and many experts believe we could be heading for a global recession. So, how will inflation (and a looming recession) impact managers, and what can they do to ride out the storm?

Global value creation stories