Comments, feedback or

suggestions?

Please contact us.

41 min. Dutch spoken

The story behind the transaction between Studio 100 and 3d investors

When bringing together the ambitious plans of entrepreneurs with investors' capital, the psychology behind a transaction is about more than just the numbers. How do these different parties create mutual trust on which to build a prosperous, long-term agenda that benefits them both?

In this podcast, Hans Bourlon, CEO of the internationally successful entertainment company Studio 100, speaks about leadership and the business of creativity; Frank Donck looks back on how he got involved with 3d investors and why he wasn't worried about lockdowns; and Philippe Fimmers reconstructs the key moments of a transaction process that took the different parties "from dream to deal."

“Eight Advisory played a key role in this process. They make what is actually very complex understandable and clear.”

Related articles

Philippe Fimmers,

Eight international

READ MORE

“Creativity was made investable”

READ MORE

Frank Donck, managing partner of 3d investors

“It’s all about the long term.”

READ MORE

DEAN NEWLUND, EXECUTIVE COACH

The business of intuition

Rationalizing intuition. Making the impossible, possible.

PODCAST

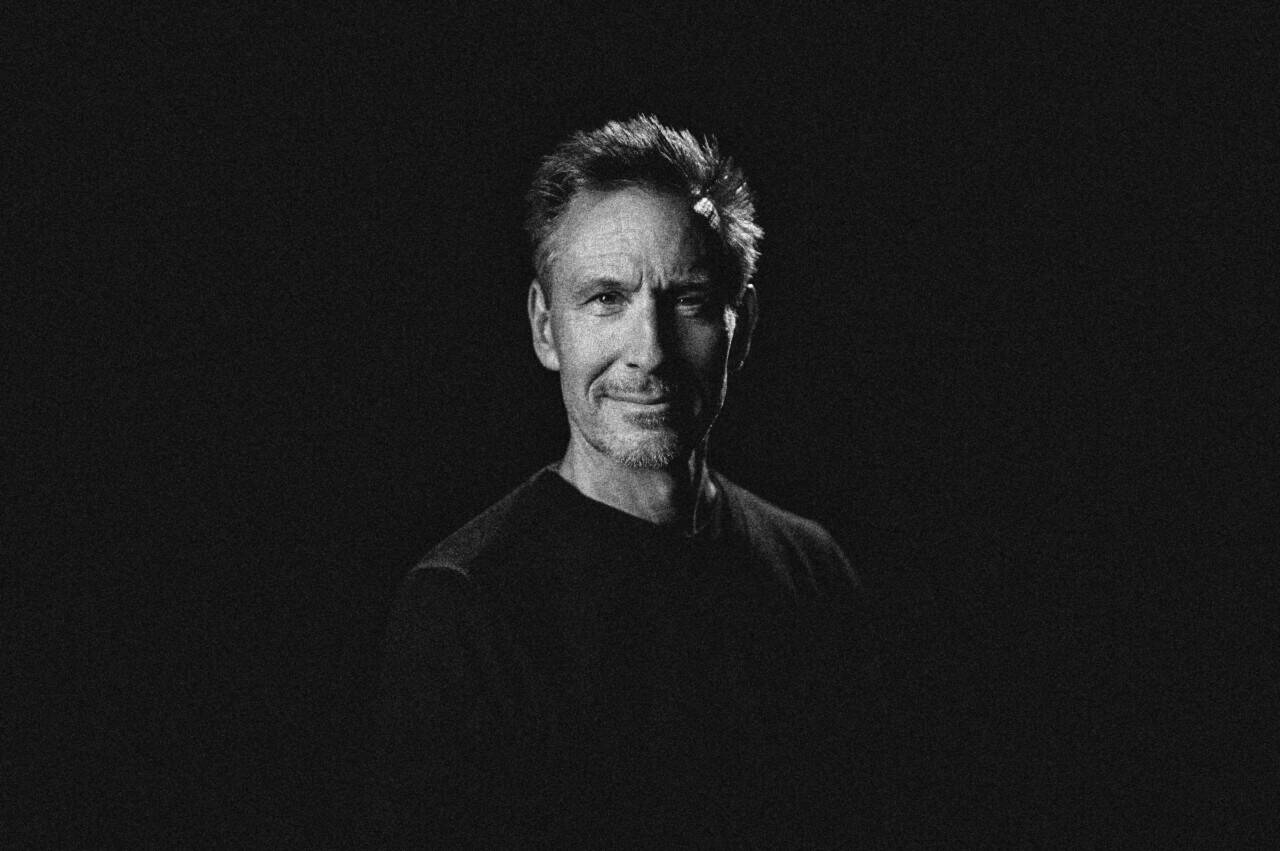

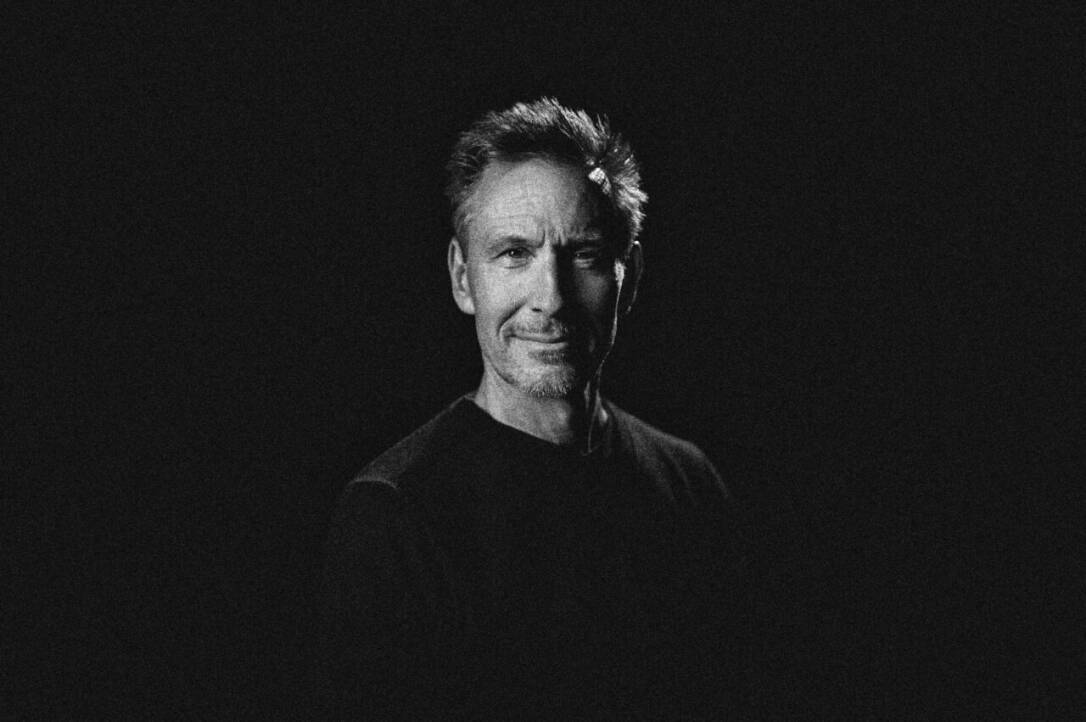

Hans Bourlon, CEO STUDIO 100

“It’s just as much about filling in

the blank sheet as the spreadsheet.”

Corporate website

©2023 Eight International

Global value creation stories

Bio

Hans Bourlon is Co-Founder and CEO of the Belgian production company Studio 100. Over more than 25 years, Studio 100 has grown into one of the world’s largest independent family entertainment companies.

Shortly after closing, COVID-19 struck, and that was another blow after the impact of digitalization in the film industry.

How did you choose 3d investors? “Eight Advisory played a key role in this process. They make what is actually very complex understandable and clear. The valuation of the company is in good hands with an advisor who can properly identify the current value and the potential. At the end of the day, it’s important that everyone’s happy with the outcome, so you need clarity. You can write the principle on the back of a beer mat, but it’s important to give it a clear and solid foundation so there are no financial, commercial, legal, or fiscal loopholes.”

And why did you choose 3d investors? “‘For a few different reasons. A Flemish party understands what something like K3 has meant to entire generations and what kind of an impact Samson has had across generations. In addition, 3d is a substantial and important player. It’s an investment firm with a great deal of managerial experience; Frank Donck, for example, was chair of Telenet. The fact that the firm also thinks in the long term is a welcome detail. It ensures a high level of strategic discussion, especially in a fast-changing world where decisions have to be made at a strategic level. But in our business, creativity is still the driving force, and it doesn’t come from doing market research or analyzing spreadsheets. After all, who comes up with the idea to give the girls from K3 pig snouts to make a musical successful? It attracted an audience of 300,000 people. Or who would have thought that a song like Waterval, which was written in 10 minutes, would be sung in every kindergarten one day? Henry Ford once said that if he’d asked people what they wanted, they would have said faster horses. They wouldn’t have asked for a Model T. In our case, they would have said: ‘A nice musical, please.’ But which one?”

Especially as they lived on in the minds of hundreds of millions of parents and grandparents. We thought that with digitalization and the fragmentation of attention, we could do something in a simple way to bring these characters back to life and do something with the nostalgia and history that surrounds them. We want to create special moments in the lives of children and their parents and grandparents.”

What was the purpose of new investments? “It was partly to introduce a new vision to our board and partly to pay out shares to the owners. Shortly after closing, COVID-19 struck, and that was another blow after the impact of digitalization in the film industry. Musicals and theme parks were not affected by this revolution in the picture industry, but they were hit hard by the pandemic. On March 13, 2020, I received a phone call from a health minister with the bad news that musicals and theme parks would have to shut down. It came out of the blue. We seemed to be heading for an unmitigated disaster, especially when it took so long. We really took the full brunt. We had sold 400,000 tickets for shows that had to be canceled. Fortunately, the government came to our aid with appropriate measures. Our plans had fallen by the wayside, but we were lucky to have shareholders who were in it for the long haul. The figures from this period have created lasting scars: about 45 million euros in cash evaporated and we also lost people with great potential. But I had read somewhere that 100 years ago, after the Spanish flu, the theatre business was booming. That gave me hope. Indeed, it took a while, but the parks and theatres are doing very well again.”

Free spirit and luck

What makes you and Gert such a good team? “It’s our free spirit. We’ve been working together for 35 years. I was recruited from the scouting movement to make a children’s game show for a national broadcaster, and Gert, an 18-year-old boy at the time, was asked to present it. That’s how it all began, and we both jumped at the opportunity at a time when public broadcasting was stagnating. We didn’t have much of a plan, and we started out with a talking dog with a hairdresser. But it was the right thing to do at the time. The songs we made caught on. Gert was the man with the boundless dream. I was better at structuring and channeling those dreams. Sometimes I had to literally finish songs that Gert had written the first verse or chorus of, because he had already moved on to something else.”

What has been your experience with investors? “A few years after our co-founder of Studio 100, Danny Verbiest, left, Gert and I felt the huge debt burden of buying out. That’s when BNP Paribas Fortis Private Equity came in. That was more than 15 years ago. We also had international plans at the time. We had our first theme park, but we wanted to break through the language barrier. We wanted to make a German acquisition, the estate of Leo Kirch, with the entire Astrid Lindgren catalogue, including Pippi Longstocking, Maya the Bee, Heidi, and Vicky the Viking. Economically speaking, these characters had more or less hit a wall, but we believed they were worth reviving.

“The unique thing since its inception is that we’ve always started with a blank sheet of paper and managed to build on that”, says Hans Bourlon, chairman of Studio 100. ‘That’s how Gert and I operated for the first 10 to 15 years, not relying on procedures but on spirit. We started with a TV show about a talking dog and his owner and some songs in the golden age of the CD. We’ve always tried to retain that frivolity. I never would have dreamed that this TV show, some songs, and some other shows would grow into a company with 11 theme parks and an animation company in Sydney that employs 450 people.”

“What I do today is completely different from what I did 15 years ago. Now it’s very corporate and I mainly focus on what we’ll be doing in three or five years’ time. And yes, that’s definitely quite different from writing a Samson song. I really miss that, but now I work with people who are much better at that and can do much more. Gert and I can stay out of the way, and we have no problem putting others in the spotlight, people in the company who have a knack for business. It’s about surrounding yourself with people who can do what you’re not so good at yourself. Meanwhile, you have to train yourself to be able to talk to specialists.”

“A rooster might think the sun is rising because he’s crowing,” says Studio 100’s CEO. “But the COVID-19 crisis and digitalization have taught us that this isn’t how the world works. Of course, it still comes down to creativity, but it also depends on a board that can make strategic choices in this complex world.”

Related articles

READ MORE

DEAN NEWLUND, EXECUTIVE COACH

The business of intuition

READ MORE

Frank Donck, managing partner

of 3d investors

“It’s all about the long term.”

READ MORE

Philippe Fimmers, Eight international

“Creativity was made investable”

How did you choose 3d investors? “Eight Advisory played a key role in this process. They make what is actually very complex understandable and clear. The valuation of the company is in good hands with an advisor who can properly identify the current value and the potential. At the end of the day, it’s important that everyone’s happy with the outcome, so you need clarity. You can write the principle on the back of a beer mat, but it’s important to give it a clear and solid foundation so there are no financial, commercial, legal, or fiscal loopholes.”

And why did you choose 3d investors? “‘For a few different reasons. A Flemish party understands what something like K3 has meant to entire generations and what kind of an impact Samson has had across generations. In addition, 3d is a substantial and important player. It’s an investment firm with a great deal of managerial experience; Frank Donck, for example, was chair of Telenet. The fact that the firm also thinks in the long term is a welcome detail. It ensures a high level of strategic discussion, especially in a fast-changing world where decisions have to be made at a strategic level. But in our business, creativity is still the driving force, and it doesn’t come from doing market research or analyzing spreadsheets. After all, who comes up with the idea to give the girls from K3 pig snouts to make a musical successful? It attracted an audience of 300,000 people. Or who would have thought that a song like Waterval, which was written in 10 minutes, would be sung in every kindergarten one day? Henry Ford once said that if he’d asked people what they wanted, they would have said faster horses. They wouldn’t have asked for a Model T. In our case, they would have said: ‘A nice musical, please.’ But which one?”

“Eight Advisory played a key role in this process. They make what is actually very complex understandable and clear.”

Especially as they lived on in the minds of hundreds of millions of parents and grandparents. We thought that with digitalization and the fragmentation of attention, we could do something in a simple way to bring these characters back to life and do something with the nostalgia and history that surrounds them. We want to create special moments in the lives of children and their parents and grandparents.”

What was the purpose of new investments? “It was partly to introduce a new vision to our board and partly to pay out shares to the owners. Shortly after closing, COVID-19 struck, and that was another blow after the impact of digitalization in the film industry. Musicals and theme parks were not affected by this revolution in the picture industry, but they were hit hard by the pandemic. On March 13, 2020, I received a phone call from a health minister with the bad news that musicals and theme parks would have to shut down. It came out of the blue. We seemed to be heading for an unmitigated disaster, especially when it took so long. We really took the full brunt. We had sold 400,000 tickets for shows that had to be canceled. Fortunately, the government came to our aid with appropriate measures. Our plans had fallen by the wayside, but we were lucky to have shareholders who were in it for the long haul. The figures from this period have created lasting scars: about 45 million euros in cash evaporated and we also lost people with great potential. But I had read somewhere that 100 years ago, after the Spanish flu, the theatre business was booming. That gave me hope. Indeed, it took a while, but the parks and theatres are doing very well again.”

When bringing together the ambitious plans of entrepreneurs with investors' capital, the psychology behind a transaction is about more than just the numbers. How do these different parties create mutual trust on which to build a prosperous, long-term agenda that benefits them both?

In this podcast, Hans Bourlon, CEO of the internationally successful entertainment company Studio 100, speaks about leadership and the business of creativity; Frank Donck looks back on how he got involved with 3d investors and why he wasn't worried about lockdowns; and Philippe Fimmers reconstructs the key moments of a transaction process that took the different parties "from dream to deal."

41 min. Dutch spoken

The story behind the transaction between Studio 100 and 3d investors

PODCAST

Rationalizing intuition. Making the impossible, possible.

Free spirit and luck

What makes you and Gert such a good team? “It’s our free spirit. We’ve been working together for 35 years. I was recruited from the scouting movement to make a children’s game show for a national broadcaster, and Gert, an 18-year-old boy at the time, was asked to present it. That’s how it all began, and we both jumped at the opportunity at a time when public broadcasting was stagnating. We didn’t have much of a plan, and we started out with a talking dog with a hairdresser. But it was the right thing to do at the time. The songs we made caught on. Gert was the man with the boundless dream. I was better at structuring and channeling those dreams. Sometimes I had to literally finish songs that Gert had written the first verse or chorus of, because he had already moved on to something else.”

What has been your experience with investors? “A few years after our co-founder of Studio 100, Danny Verbiest, left, Gert and I felt the huge debt burden of buying out. That’s when BNP Paribas Fortis Private Equity came in. That was more than 15 years ago. We also had international plans at the time. We had our first theme park, but we wanted to break through the language barrier. We wanted to make a German acquisition, the estate of Leo Kirch, with the entire Astrid Lindgren catalogue, including Pippi Longstocking, Maya the Bee, Heidi, and Vicky the Viking. Economically speaking, these characters had more or less hit a wall, but we believed they were worth reviving.

Shortly after closing, COVID-19 struck, and that was another blow after the impact of digitalization in the film industry.

Bio

Hans Bourlon is Co-Founder and CEO of the Belgian production company Studio 100. Over more than 25 years, Studio 100 has grown into one of the world’s largest independent family entertainment companies.

“The unique thing since its inception is that we’ve always started with a blank sheet of paper and managed to build on that”, says Hans Bourlon, chairman of Studio 100. ‘That’s how Gert and I operated for the first 10 to 15 years, not relying on procedures but on spirit. We started with a TV show about a talking dog and his owner and some songs in the golden age of the CD. We’ve always tried to retain that frivolity. I never would have dreamed that this TV show, some songs, and some other shows would grow into a company with 11 theme parks and an animation company in Sydney that employs 450 people.”

“What I do today is completely different from what I did 15 years ago. Now it’s very corporate and I mainly focus on what we’ll be doing in three or five years’ time. And yes, that’s definitely quite different from writing a Samson song. I really miss that, but now I work with people who are much better at that and can do much more. Gert and I can stay out of the way, and we have no problem putting others in the spotlight, people in the company who have a knack for business. It’s about surrounding yourself with people who can do what you’re not so good at yourself. Meanwhile, you have to train yourself to be able to talk to specialists.”

“A rooster might think the sun is rising because he’s crowing,” says Studio 100’s CEO. “But the COVID-19 crisis and digitalization have taught us that this isn’t how the world works. Of course, it still comes down to creativity, but it also depends on a board that can make strategic choices in this complex world.”

Corporate website

©2023 Eight International

Global value creation stories

Hans Bourlon, CEO STUDIO 100

“It’s just as much about filling in the blank sheet

as the spreadsheet.”