Comments, feedback or

suggestions?

Please contact us.

READ MORE

DEAN NEWLUND, EXECUTIVE COACH

The business of intuition

Related articles

Frank Donck, managing partner of 3d investors

“It’s all about the long term.”

READ MORE

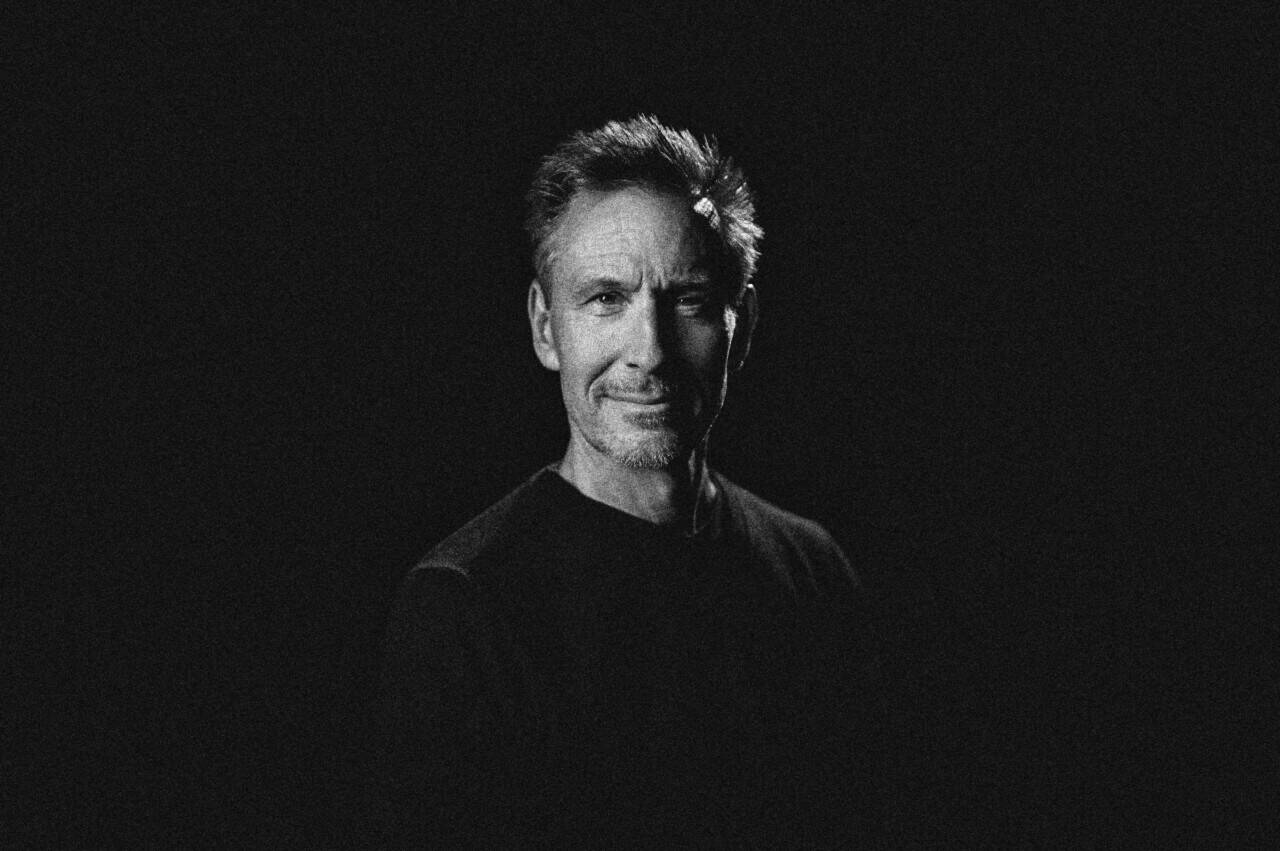

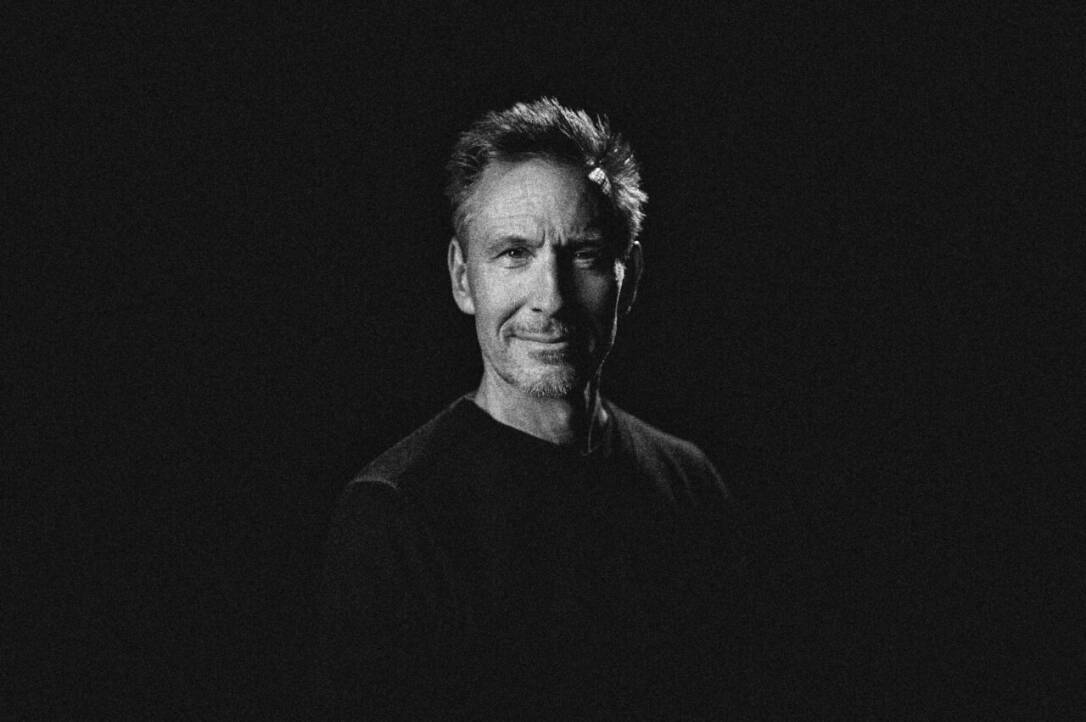

Philippe Fimmers,

Eight INTERNATIONAL

“We turned

passion into tangible value.”

READ MORE

HANS BOURLON, CEO STUDIO 100

The sequel to sustainability

“From the outset, this project involved a number of unique challenges,” says the Managing Partner of Eight Advisory Benelux, who, as financial due diligence advisor, assisted the founders of Studio 100 in their quest to obtain a long-term investor. “Not least of these was the impact of the COVID-19 pandemic, which we couldn’t have foreseen. However, throughout the process, our support and advice proved sound.”

Corporate website

©2023 Eight International

Global value creation stories

People and emotions

Can you explain more about what goes into a strong partnership like this? “Contrary to what many might think, due diligence isn’t just about crunching numbers and checking legal and tax documents. The human aspect is equally important, especially in investments like this. You have to meet – and really get to know – the people involved in the process, and ask critical questions to gain a better understanding of the team’s capabilities and vision. This approach relies on building trust, which is ultimately essential for a successful investment. And this trust is founded not just on numbers, but also, and more importantly, on human emotion and intuition. At Eight Advisory, we use the expertise of our young and experienced team members alike to analyze and interpret both the data and the personal side of things effectively. Ultimately, it's about finding the right match between entrepreneurs and investors who share a long-term vision and respect each other's strengths. The value they bring goes beyond financial success: let’s not forget the importance of investing in people and nurturing relationships.”

You seem very enthusiastic about what you do? “I love my work because it always gives me the opportunity to interact with a wide range of people from all kinds of sectors and to experience their entrepreneurial passion at first hand. Part of my job is to immerse myself in their stories and understand their work, vision, and passion – allowing me to then translate it into actionable goals. Whether I’m working for the buyer or the seller, my goal is always to foster mutual understanding and respect between both parties. Ultimately, this is a business based on trust, and earning the trust and respect of both parties is the only way to ensure a successful outcome.”

COVID-19

The deal was struck shortly before the global COVID-19 outbreak and involved a long-term investment in a business whose revenues rely heavily on physical contact with people, via (for instance) concerts and theme parks. How did you respond? “The pandemic obviously proved to be a major challenge for Studio 100, testing the strength of the investment and the relationship between the company and the investor. But, despite the obstacles, the company persevered in looking for growth opportunities, resulting in impressive performance metrics. Although the pandemic caused some deviations from the original plan, the investor's knowledge and experience proved invaluable. Importantly, both sides were able to build and maintain a mutual respect throughout the process. The investor – a family investor, in fact – was committed to the long-term success of the company and was able to overlook the difficulties of the pandemic. Meanwhile, the company's management team demonstrated exceptional resourcefulness, creativity, and determination in managing short-term liquidity while investing in the future. Studio 100 has found a perfect partner and we’re very pleased to have been able to contribute to this success.”

“Eight Advisory is more than a financial due diligence advisor: we’re also an operational and strategic advisory firm, looking at companies from a very broad perspective that enables them to make informed decisions based on a range of firm and soft factors,” says Philippe Fimmers. “In the case of the Studio 100 investment, our task was to present the company to the investor from very different perspectives and, in particular, to explain the two different spheres: the world of pure creativity, where the magic happens and entertainment is created, and the world of tangible business, namely the theme parks where the characters created by Studio 100 are brought to life. These are very specific business models that are closely connected but have very different dynamics. The challenge was to translate these different worlds into a coherent language of investment and finance: to show the key business drivers, shed light on the creation process, present the vision of the creators, and, last but not least, explain where the profitability of the business comes from.”

The due diligence process allowed the team to look three years into the past and five years into the future. Does this relatively short period of time – in today’s highly unpredictable world – allow you to fully demonstrate the business potential of the founders’ vision and translate it into simple numbers? “This is exactly where the tangible value of the business is created. In other words: we assign value to the company’s ability to develop ‘something’ from ‘nothing’ and to grow in the future. Consider the K3 band concept, or Samson & Gert (now Marie), which have been around for so long and continue to exist through films, songs, merchandising, and theme parks. There’s a certain balance where short- and long-term value are created.”

Bio

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua.

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua.

For us, the key is to quantify the characters that come to life here.

Bio

Philippe Fimmers is a Founding Partner of Eight Advisory Belgium and the Managing Partner of Eight Advisory Benelux. He has more than 22 years of transaction and restructuring experience and is an expert in due diligence, turnaround and restructuring, debt and capital advisory, and distressed M&A.

41 min. Dutch spoken

The story behind the transaction between Studio 100 and 3d investors

Rationalizing intuition.

Making the impossible possible.

PODCAST

READ MORE

HANS BOURLON, CEO STUDIO 100

The sequel to sustainability

Related articles

READ MORE

DEAN NEWLUND, EXECUTIVE COACH

The business of intuition

READ MORE

Frank Donck, managing partner

of 3d investors

“It’s all about the long term.”

41 min. Dutch spoken

The story behind the transaction between Studio 100 and 3d investors

Rationalizing intuition.

Making the impossible possible.

PODCAST

People and emotions

Can you explain more about what goes into a strong partnership like this? “Contrary to what many might think, due diligence isn’t just about crunching numbers and checking legal and tax documents. The human aspect is equally important, especially in investments like this. You have to meet – and really get to know – the people involved in the process, and ask critical questions to gain a better understanding of the team’s capabilities and vision. This approach relies on building trust, which is ultimately essential for a successful investment. And this trust is founded not just on numbers, but also, and more importantly, on human emotion and intuition. At Eight Advisory, we use the expertise of our young and experienced team members alike to analyze and interpret both the data and the personal side of things effectively. Ultimately, it's about finding the right match between entrepreneurs and investors who share a long-term vision and respect each other's strengths. The value they bring goes beyond financial success: let’s not forget the importance of investing in people and nurturing relationships.”

You seem very enthusiastic about what you do? “I love my work because it always gives me the opportunity to interact with a wide range of people from all kinds of sectors and to experience their entrepreneurial passion at first hand. Part of my job is to immerse myself in their stories and understand their work, vision, and passion – allowing me to then translate it into actionable goals. Whether I’m working for the buyer or the seller, my goal is always to foster mutual understanding and respect between both parties. Ultimately, this is a business based on trust, and earning the trust and respect of both parties is the only way to ensure a successful outcome.”

Bio

Philippe Fimmers is a Founding Partner of Eight Advisory Belgium and the Managing Partner of Eight Advisory Benelux. He has more than

22 years of transaction and restructuring experience and is an expert in due diligence, turnaround and restructuring, debt and capital advisory, and distressed M&A.

COVID-19

The deal was struck shortly before the global COVID-19 outbreak and involved a long-term investment in a business whose revenues rely heavily on physical contact with people, via (for instance) concerts and theme parks. How did you respond? “The pandemic obviously proved to be a major challenge for Studio 100, testing the strength of the investment and the relationship between the company and the investor. But, despite the obstacles, the company persevered in looking for growth opportunities, resulting in impressive performance metrics. Although the pandemic caused some deviations from the original plan, the investor's knowledge and experience proved invaluable. Importantly, both sides were able to build and maintain a mutual respect throughout the process. The investor – a family investor, in fact – was committed to the long-term success of the company and was able to overlook the difficulties of the pandemic. Meanwhile, the company's management team demonstrated exceptional resourcefulness, creativity, and determination in managing short-term liquidity while investing in the future. Studio 100 has found a perfect partner and we’re very pleased to have been able to contribute to this success.”

For us, the key is to quantify the characters that come to life here.

“From the outset, this project involved a number of unique challenges,” says the Managing Partner of Eight Advisory Benelux, who, as financial due diligence advisor, assisted the founders of Studio 100 in their quest to obtain a long-term investor. “Not least of these was the impact of the COVID-19 pandemic, which we couldn’t have foreseen. However, throughout the process, our support and advice proved sound.”

“Eight Advisory is more than a financial due diligence advisor: we’re also an operational and strategic advisory firm, looking at companies from a very broad perspective that enables them to make informed decisions based on a range of firm and soft factors,” says Philippe Fimmers. “In the case of the Studio 100 investment, our task was to present the company to the investor from very different perspectives and, in particular, to explain the two different spheres: the world of pure creativity, where the magic happens and entertainment is created, and the world of tangible business, namely the theme parks where the characters created by Studio 100 are brought to life. These are very specific business models that are closely connected but have very different dynamics. The challenge was to translate these different worlds into a coherent language of investment and finance: to show the key business drivers, shed light on the creation process, present the vision of the creators, and, last but not least, explain where the profitability of the business comes from.”

The due diligence process allowed the team to look three years into the past and five years into the future. Does this relatively short period of time – in today’s highly unpredictable world – allow you to fully demonstrate the business potential of the founders’ vision and translate it into simple numbers? “This is exactly where the tangible value of the business is created. In other words: we assign value to the company’s ability to develop ‘something’ from ‘nothing’ and to grow in the future. Consider the K3 band concept, or Samson & Gert (now Marie), which have been around for so long and continue to exist through films, songs, merchandising, and theme parks. There’s a certain balance where short- and long-term value are created.”

Philippe Fimmers,

Eight INTERNATIONAL

“We turned

passion into tangible value.”

Corporate website

©2023 Eight International

Global value creation stories